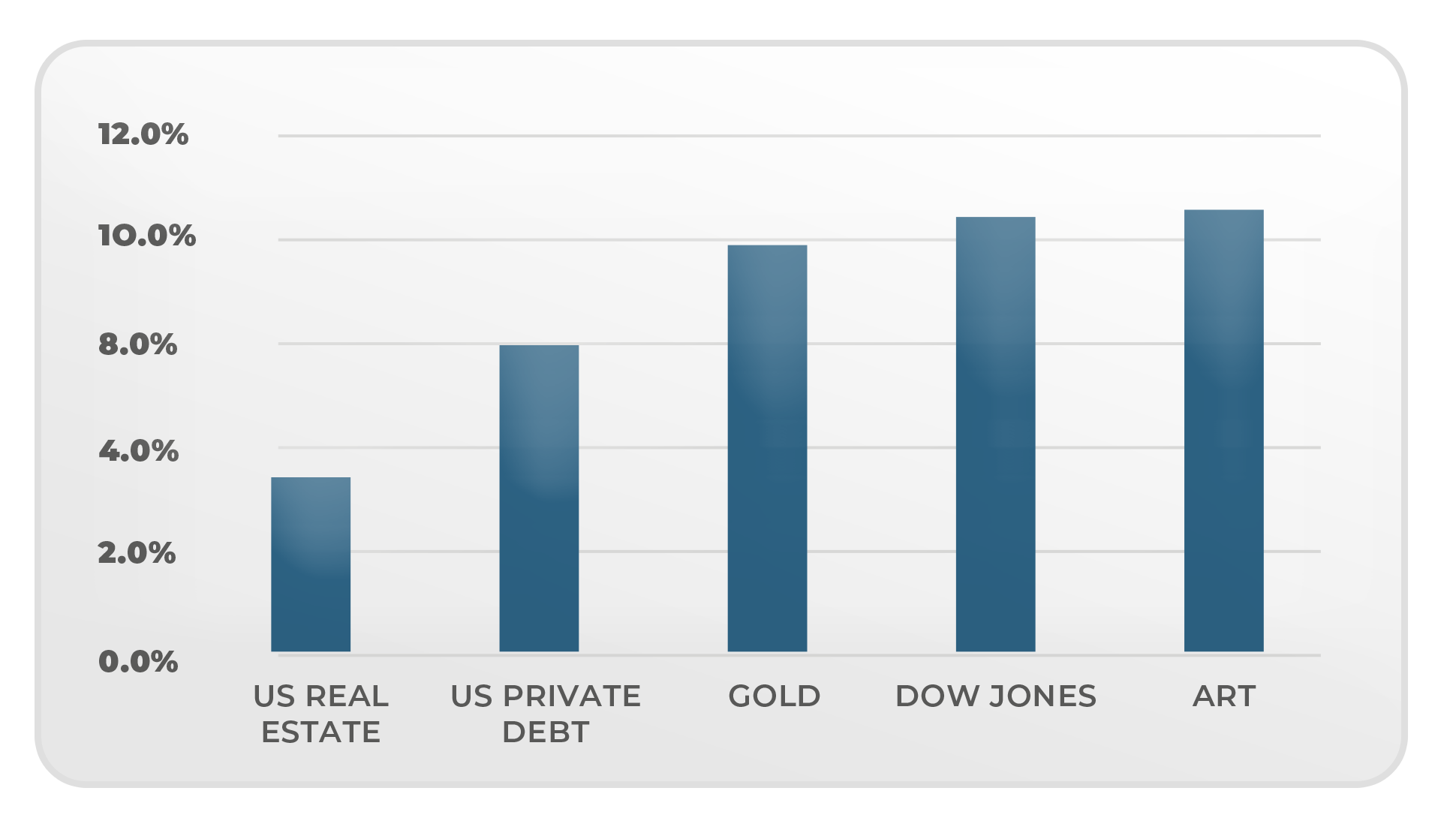

Blue Chip Art has increased 10.5% per year in value over the last 20 years.

The Collector Choice Art Fund is a Luxembourg based investment structure regulated by the CSSF and the Central Bank of Luxembourg.

The Collectors Choice Art Fund is a Luxembourg based investment regulated by the Comission de Surveillance du Secteur Financier (CSSF) and the Central Bank of Luxembourg.

Brian Chiswell and Gerardo Zurbrugg of British and Swiss origin respectively are the founders and directors of The Collectors Choice. Both count with extensive experience in art and private investment having established The Collectors Choice as a Vienna stock market art fund in 2015. Both bring an extensive network of gallery, collector and art dealer contacts from New York, Mexico City, London, Zurich, Sao Paulo, Hong Kong and Beijing.

The fund’s art committee led by Georgina Pounds is made up of consultants with Sothebys and Christies experience as as art dealers and leading gallerists. The committee is constantly reviewing, studying and analyzing works of art for quality, provenance and market value before making an investment. Over fifty works of art are analyzed before the fund makes a purchase. Artwork is exhibited at museums, art fairs and galleries for 2 to 3 years.

Georgina Pounds brings invaluable experience as Art Director to The Collectors Choice. Pounds, of English origin is the founder of Georgina Pounds Gallery and Studio Lazcano, both in Mexico City. Previously she was the Director of OMR, Mexico City (2023- 2025) and prior to that the Director at Hilario Galguera, Mexico City and Madrid (2018-2023). In the summer months, she advises Orto Botanico Corsini Sculpture Gardens in Porto Ercole, Tuscany Italy. Before to her time in Mexico, Pounds worked for the Murderme collection in London (2015-2018) and from (2013-2015) with Science working on Damien Hirst’s “Treasures of the Wreck of the Unbelievable” in Venice. She has a BA in Architecture from The University of Liverpool and an MA in Architecture from the CASS London.

1

2

3

| Total Issue Size | $50,000,000 |

| Minimum Investment | $50,000 |

| Art Fund Target Return | 9% pa |

| Liquidity | June & December (with 45 day notice) |

| Art & Fund Valuation | June & December |

| Portfolio Manager | Collectors Choice Ltd |

| ISIN Code | CH1108675716 |

| Bond Issuer | AAFS Luxembourg |

| Bond Price Listing | Bloomberg. Telekurs. |

| Bonds Clearing | SIX SIS AG / Clearstream / Euroclear |

| TCC Art Fund II Regulators |

Luxembourg Central Bank / CSSF |

| Paying Agent | ISP Securities (Luxembourg) |

| Management Fee | 1.5% |

| Investment Assets | Contemporary Masters Blue Chip Art |

| Type of Artwork | Paintings, Sculpture, Drawings |

The Collectors Choice Art Fund is a listed financial market investment bond (ISIN CH1108675716) regulated by the Luxembourg Central Bank & the CSSF. For detailed information on how to invest through your private banker and please access the following link: https://thecollectorschoice.com/invest/ For further information please contact us through the message box below or directly at info@thecollectorscoice.com and one of our consultants will get back to you.

The Collectors Choice Art Fund is a listed financial market investment bond (ISIN CH1108675716) regulated by the Luxembourg Central Bank & the CSSF.

info@thecollectorschoice.com

Pontum Mgmt SC

Bosques de Duraznos 65

11700 Mexico DF

Mexico

Adding {{itemName}} to cart

Added {{itemName}} to cart